Tax regulations in Nigeria require that eBay collects Value Added Tax on fees charged to both private and business sellers residing in this country. When charged by eBay, this tax is included in seller invoices and remitted by eBay to the Nigerian tax authorities.

Due to Nigerian tax regulations, eBay will charge Nigerian VAT on the eBay fees. From April 2024, Nigerian VAT of 7.5% will apply to all fees paid by all eBay sellers (both B2C and C2C) resident in Nigeria.

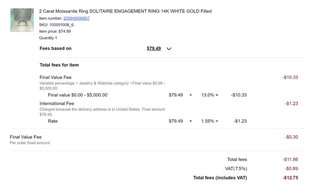

You can keep track on the fees on the Fees tab in your Seller Hub:

Seller Hub > Payments > All transactions > Fees

eBay net fees will not be affected by these regulations and there will be no change to the services provided to you. Also, this will not impact your listings and you will not need to update anything.

For more information read eBay's tax policy. If you have questions regarding your VAT obligations, please contact your tax adviser/accountant or responsible local tax office.