Starting on 1 January 2021, the UK introduced a new model for imports to ensure goods from outside of the UK are treated in the same way as goods already in the UK.

The VAT exemption is abolished.

eBay collects and remits VAT for UK imports on all consignments with a value of up to £135. In cases where the seller is a non-UK business and the goods are already in the UK, eBay collects and remits VAT for goods sold to consumers within the UK, regardless of their value.

Depending on whether you have a BUSINESS account registered on ebay.co.uk, there are different scenarios and actions for you.

You DON’T have a BUSINESS account registered on ebay.co.uk

Be aware that for UK buyers VAT of 20% will be added automatically to your item price and eBay will pay it to UK governance.

Example scenario for you:

US listing with UK browsing experience and delivery address

Goods listed in the US. A buyer is browsing from the UK site, and the item will be delivered to the UK. Price displayed to the buyer includes UK VAT. Checkout will display 20% VAT, as it is UK delivery.

| Listing site: | US |

| Buyer browsing site: | UK |

| Buyer country: | UK |

| Net price: | 100 |

| Seller input VAT: | N/A |

| Seller listing price: | 100 |

| Correct VAT: | 20% |

| Search Results Page (SRP) price: | 120 |

| Checkout price: | 120 |

Because the buyer is browsing on the UK site, the items will be listed with an SRP of 120 (including UK VAT), not 100. From a legal POV, all prices on the UK website need to show the price including the UK VAT. Checkout price will include UK VAT, as delivery is in the UK.

You HAVE a BUSINESS account registered on ebay.co.uk

Starting March 1, 2021 business sellers trading with UK buyers and listing on the UK site (ebay.co.uk) or EU eBay sites have two options:

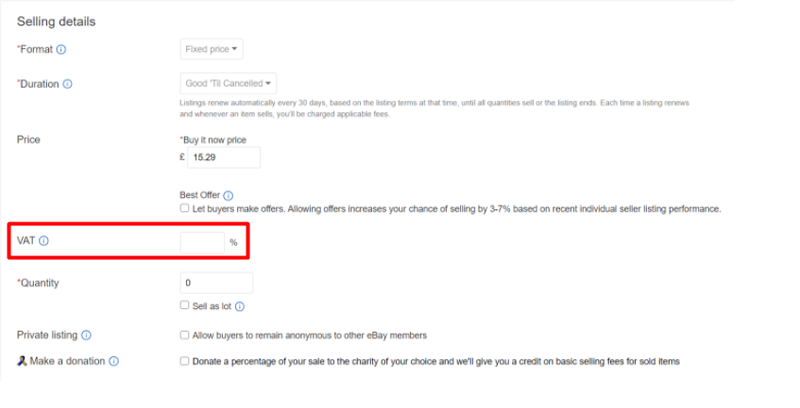

- provide net price of the item and leave the field for entering the VAT rate empty - eBay will calculate and charge VAT itself based on the location of the seller, buyer and item;

- provide gross price of the item and in a separate field — the VAT rate included in the cost.

If you don’t have this field please contact Customer Service or your Growth Advisor.

There are two ways to set VAT rate:

1) Set VAT rate = 0%

In this case eBay will treat item price as a net price and will add 20% on top of it for the buyers from the UK (a buyer pays 120%, the seller gets 100% of the item price).

2) Set VAT rate = 20%

In this case eBay will treat item price as a gross price and will collect 20% VAT if the buyer is from the UK (a buyer pays 100%, the seller gets ~83% of the item price).

If you do not provide this information on time or set 0% VAT, eBay will have to assume that your price provided is the net price and will automatically add UK VAT on top to the prices displayed to buyers.

Example scenarios for you:

Scenario 1

UK listing & browsing experience & delivery address

Goods listed in the UK and delivered to the UK. Price displayed to the buyer includes UK VAT. Checkout will display UK VAT based on the UK delivery address.

| ⠀ | ⠀ |

|---|---|

| Listing site: | UK |

| Buyer browsing site: | UK |

| Buyer country: | UK |

| Net price: | 100 |

| Seller input VAT: | 10% |

| Seller listing price: | 110 |

| Correct VAT: | 20% |

| Search Results Page (SRP) price: | 120 |

| Checkout price: | 120 |

eBay will override seller VAT when C&R applies (excluded import case exceeding GBP 135).

Scenario 2

UK listing & browsing experience and US delivery address

Goods listed in the UK are delivered to the US. Price displayed to the buyer includes UK VAT. Checkout will display 0% VAT based on the US delivery address.

| ⠀ | ⠀ |

|---|---|

| Listing site: | UK |

| Buyer browsing site: | UK |

| Buyer country: | US |

| Net price: | 100 |

| Seller input VAT: | 20% |

| Seller listing price: | 120 |

| Correct VAT: | 20% |

| Search Results Page (SRP) price: | 120 |

| Checkout price: | 120 |

Because the buyer is browsing on the UK site, the items will be listed with an SRP of 120 (incl. UK VAT). Checkout will charge original price as given by the seller where applicable based on the delivery address.

Your eBay invoice will contain information about paid VAT. On the matter of filing tax returns contact your tax advisor

Information above is not intended as tax or legal advice. We recommend that you seek independent tax or legal advice to ensure compliance with applicable laws and regulations. You can also find additional information on https://www.gov.uk/transition

Please contact your shipping provider for more information on the customs process.