This article explains the fees and benefits of opening a Store on ebay.com only.

If you don’t have a Store subscription, please read the Selling fees for eBay sellers article

If you're planning to sell on international eBay sites (like ebay.de, ebay.es, ebay.it, ebay.fr, ebay.com.au), please read the Selling fees for eBay sellers article

If you're planning to sell a vehicle on eBay Motors, please read the Fees for selling vehicles on eBay Motors article

You can save on eBay fees by running your own eBay Store. The benefits you see will vary depending on the type of Store subscription you choose, and this article will help you make the best choice.

When you have an eBay Store subscription, you get more listings with zero insertion fees and pay lower final value fees, compared to selling without a Store. Keep in mind, eBay charges an insertion fee when you create a listing, and a final value fee when your item sells. You also get access to additional tools to manage and promote your business.

The rest of the fee structure is the same as for sellers who don't have an eBay Store. eBay charges an insertion fee when you create a listing, and a final value fee when your item sells.

The selling fees for eBay Store subscribers depend on:

- Item price

- Category

- Format

- Optional listing upgrades— they always incur extra fees, but you can decide whether to use them or not

- Subscription level

- Your seller level and seller performance

How to choose an eBay Store package

When you open an eBay Store on ebay.com, you'll choose a Store package:

- Starter

- Basic

- Premium

- Anchor

- Enterprise

Before you open an eBay Store, you'll need an eBay seller account with an automatic payment method on file.

You can also choose one of two Store subscription durations:

- Monthly subscription (with a one month term that automatically renews monthly)

- Yearly subscription (with a one year term that automatically renews yearly)

When you first subscribe, you can choose between automatic monthly or yearly renewals. For either option, eBay charges the subscription fee on a monthly basis.

eBay Store subscription fee per month

| Store type | Store subscription fee per month. Monthly renewal | Store subscription fee per month. Yearly renewal |

|---|---|---|

| Starter | $7.95 | $4.95 |

| Basic | $27.95 | $21.95 |

| Premium | $74.95 | $59.95 |

| Anchor | $349.95 | $299.95 |

| Enterprise | Not currently available | $2,999.95 |

eBay will charge you for your Store every month until you cancel your subscription. To find out how fees are charged when you change your Store level or cancel your subscription/close your Store, please read How to close your eBay Store and the Stores Subscription Terms of Service.

Subscribing to an eBay Store not only gives you discounted fees and more free listings per month, you also get access to additional tools to manage and promote your business. Some of them are available to all eBay Store subscribers, while others are only available for higher-tier subscriptions. You can find more details in the table below.

Insertion fees and zero insertion fee listings

All sellers get a monthly allocation of zero insertion fee listings. When you have an eBay Store subscription, you get more zero insertion fee listings per month than sellers who don't have a Store. The number you get depends on the Store subscription package you choose.

All existing selling limits on your account (as well as category and item limits) still apply and may prevent you from creating the maximum number of listings associated with your eBay Store subscription.

Certain categories are excluded from the zero insertion fee listings offer.

After you've used your zero insertion fee allowance, insertion fees are:

- Nonrefundable if your item doesn't sell

- Charged per listing and per category. So if you list your item in two categories, you'll pay an insertion fee for the second category too

- Charged for the original listing and each time your item is relisted

- Charged per listing if you create duplicate auction-style listings for identical items. Read more about eBay duplicate listings policy

- Credited back for auction-style listings that end in a sale for Basic, Premium, Anchor, and Enterprise Store subscribers (exclusions apply)

Good 'Til Cancelled listings

Good 'Til Cancelled listings are fixed price listings that renew automatically once per calendar month. eBay charges an insertion fee and applicable optional listing upgrade fees when you list your item for the first time, and each time it renews. These listings count toward your monthly zero insertion fee listings. Fee amounts are based on the terms in effect when the listing goes live and when it renews.

Zero insertion fee listings allocation per month for eBay Store subscribers

Select categories for auction-style listings

If you have a Basic, Premium, Anchor, or Enterprise Store, you can only use your zero insertion fee auction-style listings allocation in the following categories:

- Antiques

- Art

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Dolls & Bears

- Entertainment Memorabilia

- Health & Beauty

- Jewelry & Watches

- Pottery & Glass

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

Select categories for fixed price listings

You can use your "select categories" fixed price listings allocation in the following categories:

- Sports Mem, Cards & Fan Shop > Sports Trading Cards

- Toys & Hobbies > Collectible Card Games

- Collectibles

- Music

- Books & Magazines

- Movies & TV

- Video Games & Consoles > Video Games

- Stamps

- Crafts

- Home & Garden > Greeting Cards & Party Supply > Party Supplies

More information for sellers with an Enterprise Store

Sellers with an Enterprise Store subscription can earn bundles of 10,000 additional free fixed price listings by reaching sales targets.

When you complete 3,000 transactions in one month, for each additional 300 completed transactions, you will earn 10,000 free fixed price listings to be used the following month, on top of the 100,000 free fixed price listings you receive with your subscription.

Example: In September, you have 3,600 completed transactions. You earn 2 free listings bundles, which is 20,000 free fixed price listings.

- Your free listings are based on the number of completed transactions above a 3,000 minimum threshold during the month. In this case, you have 600 completed transactions above the minimum threshold (3,600 - 3,000 = 600)

- You earn 1 free listing bundle for every 300 listings above the minimum threshold. In this case, you'll earn 2 free listings bundles (600/300 = 2)

- Each free listings bundle entitles you to 10,000 free fixed price listings to be used the following month. In this case, you'll earn 20,000 free listings (2 x 10,000 = 20,000) to be used in the month of October. They will expire on October 31. This is in addition to the 100,000 free fixed price listings you receive as part of your Enterprise Store subscription

Final value fees

eBay charges one final value fee when your item sells, and you don't have to worry about third-party payment processing fees. This fee is calculated as a percentage of the total amount of the sale, plus $0.40 per order.

For orders with a total amount of the sale of $10 and under, the per order fee is $0.30.

The total amount of the sale includes the item price, any handling charges, any shipping costs collected from the buyer (some exceptions apply), sales tax, and any other applicable fees.

An order is defined as any number of items purchased by the same buyer at checkout with the same shipping method.

If you need to refund the buyer or cancel the sale, you may be eligible for fee credits as per our fee credits policy.

Please note that we charge different fees for non-Store sellers and different fees for selling vehicles in our Motors category.

Exceptions to how we calculate the final value fee on shipping

- If you offer 1-day or international shipping as well as a cheaper or free option (like domestic shipping), the total amount of the sale is calculated based on the cheapest domestic option you offer. If you only offer 1-day or international shipping but no cheaper option like domestic shipping, the total amount of the sale is calculated based on the service the buyer chooses

- If you're in China, Hong Kong, Indonesia, Israel, Japan, Macau, Malaysia, Philippines, Singapore, Taiwan, Thailand, or Vietnam and your item isn't located in the US, the total amount of the sale is always calculated based on the shipping option your buyer chooses

Starter Store subscribers

| Category | Final value fee % + per order fee |

|---|---|

| Most categories, including eBay Motors > Parts & Accessories, eBay Motors > Automotive Tools & Supplies eBay Motors > Safety & Security Accessories |

|

| Books & Magazines Movies & TV (except Movie NFTs) Music (except Music NFTs and Vinyl Records) |

|

| Most Coins & Paper Money categories, (except Bullion) |

|

| Coins & Paper Money > Bullion |

|

Select Collectibles categories:

Toys & Hobbies > Collectible Card Games |

|

| Musical Instruments & Gear > Guitars & Basses |

|

| Jewelry & Watches (except Watches, Parts & Accessories) |

|

| Jewelry & Watches > Watches, Parts & Accessories |

|

The following NFT categories:

|

|

Select Business & Industrial categories:

|

|

Select Clothing, Shoes & Accessories categories:

|

|

| Clothing, Shoes & Accessories > (Women's Bags & Handbags) |

|

Basic, Premium, Anchor, and Enterprise Store subscribers

| Category | Final value fee % + per order fee |

|---|---|

| Antiques |

|

| Most Art categories, except: |

|

|

|

| Baby |

|

| Books & Magazines |

|

| Most Business & Industrial categories, except: |

|

|

|

| Most Cameras & Photo categories, except: |

|

|

|

| Most Cell Phones & Accessories categories, except: |

|

|

|

| Most Clothing, Shoes & Accessories categories, except: |

|

|

|

|

|

| Most Coins & Paper Money categories, except: |

|

|

|

| Most Collectibles categories, except: |

|

|

|

|

|

| Most Computers/Tablets & Networking categories, except: |

|

|

|

|

|

| Most Consumer Electronics categories, except: |

|

|

|

| Crafts Dolls & Bears Entertainment Memorabilia Health & Beauty Home & Garden |

|

| Most Jewelry & Watches categories, except: |

|

|

|

eBay Motors:

|

|

|

|

| eBay Motors > Parts & Accessories > Apparel, Protective Gear & Merchandise |

|

| eBay Motors > Parts & Accessories > In-Car Technology, GPS & Security |

|

| Most Movies & TV categories, except: |

|

|

|

| Most Music categories, except: |

|

|

|

|

|

| Most Musical Instruments & Gear categories, except: |

|

|

|

|

|

| Pet Supplies Pottery & Glass Specialty Services Sporting Goods |

|

| Most Sports Mem, Cards & Fan Shop categories, except: |

|

|

|

|

|

| Stamps |

|

| Most Toys & Hobbies categories, except: |

|

|

|

|

|

| Most Video Games & Consoles categories, except: |

|

|

|

|

|

| All other categories |

|

Fees for Classified Ad listing format

Insertion fees for Classified Ads are $9.95 for a 30-day listing and there are no final value fees.

You can use the Classified Ad format in the following categories:

- Business & Industrial

- Building Materials & Supplies > Modular & Pre-Fabricated Buildings

- Office > Trade Show Displays

- Websites & Businesses for Sale

- Specialty Services

- Travel (excluding Lodging, Luggage, and Vintage Luggage & Travel Accs categories)

- Everything Else

- eBay User Tools

- Funeral & Cemetery

- Information Products

- Reward Points and Incentives Programs

Fees for Real Estate listings

Fees for Real Estate listings include an insertion fee, a notice fee, and fees for any optional listing upgrades you choose. Real Estate listings can be auction-style, fixed price, or in the Classified Ad format. No matter which format you choose, there are some rules you should be aware of, so please take a moment to read our Real estate policy.

Land, Manufactured, and Timeshare homes

| Listing type | Duration | Insertion fee | Notice fee |

|---|---|---|---|

| Auction-style | 1, 3, 5, 7, or 10-day listing (1 and 3-day auction-style listings cost an additional $1) | $35 | $35 |

| Auction-style or fixed price | 30-day auction or Good 'Til Cancelled | $50 | $35 |

| Classified Ad | 30-day listing | $150 | $0 |

| 90-day listing | $300 | $0 | - |

Commercial, Residential, and Other Real Estate

| Listing type | Duration | Insertion fee | Notice fee |

|---|---|---|---|

| Auction-style | 1, 3, 5, 7, or 10-day listing (1 and 3-day auction-style listings cost an additional $1) | $100 | $0 |

| Auction-style or fixed price | 30-day auction or Good 'Til Cancelled | $150 | $0 |

| Classified Ad | 30-day listing | $150 | $0 |

| Classified Ad | 90-day listing | $300 | $0 |

You won't be charged a notice fee if:

- Your item has no bids

- No bids meet your reserve price, if you added one

- Your item is listed in the Classified Ad format

Otherwise, we charge a notice fee, whether or not you carry out the sale with the buyer.

Fees for optional listing upgrades

You can enhance your listings to help make them stand out by adding certain features, such as subtitles or a bold font. The fees for these optional listing upgrades vary depending on your item's price and the listing format and duration.

Most of the fee structure is the same as for non-Store subscribers. You can find them in this table.

The Buy It Now listing upgrade for auction-format listings and the Scheduled listing upgrade is free for all eBay sellers:

- The Buy It Now upgrade allows you to set an item price and gives buyers the option to purchase your item immediately so they don’t have to wait for your auction to end

- The Scheduled listing upgrade gives you control to decide when to start your listings

If your listings renew automatically, you'll be charged insertion and optional listing upgrade fees each time your listing is renewed.

Other fees

You may be charged final value fees if you violate our policy of buying or selling outside of eBay, or eBay may apply additional final value fees if you are not meeting our performance expectations. Also eBay charges a Dispute fee and an International fee for Store subscribers as it does for non-Store subscribers.

Sellers not meeting performance expectations

Additional final value fees may apply on sales in the following circumstances:

- If your account is evaluated as Below Standard in the evaluation on the 20th of the month, you'll be charged an additional 6% on the final value fees applicable to sales in the following calendar month. Go to your Seller Dashboard to check your current seller level. This fee does not apply to Above Standard and eBay Top-rated Sellers

- If your rate of 'Item not as described' return requests is evaluated in your service metrics as Very High in the evaluation on the 20th of the month in one or more categories, you will be charged an additional 5% on the final value fees for sales in those categories in the following calendar month. You can view your personalized service metrics on your Service Metrics dashboard in Seller Hub

Any additional final value fees will be calculated as a percentage of the total amount of the sale. We'll indicate which listings are subject to additional fees on your Account Summary.

Note: If your account is Below Standard and you're rated Very High in your rate of 'Item not as described' return requests, you'll only be charged the additional final value fee for Below Standard.

You can find more information here:

Seller currency conversion charge

When you create listings or sell items on an international eBay site, eBay may convert your funds to a different currency in order to collect amounts owed by you to eBay, or to payout funds due to you.

For example, if your registered address is in the US and you create a listing on eBay.de for which fees are due (such as insertion and/or optional listing upgrade fees), eBay will convert your funds from USD to EUR using the transaction exchange rate applicable at the time of listing, in order to collect these fees. When the item sells on eBay.de, eBay will calculate your payout amount by converting the sales proceeds from EUR to USD using the transaction exchange rate applicable at the time of the sale.

If eBay converts your funds, the conversion will be completed at the transaction exchange rate eBay set for the relevant currency exchange. eBay's transaction exchange rate is composed of a base exchange rate plus a conversion charge. The conversion charge is a fixed percentage applied to the base exchange rate and retained by eBay. The base exchange rate reflects rates within the wholesale currency markets applicable to the currency pairing on the day of the conversion, or the prior business day. If exchange rates are set by law or regulation, the base exchange rate reflects the government reference rates.

If your registered address is in the US, the seller currency conversion charge applied and retained by eBay is 3%. If your registered address is not in the US, please refer to the fee page for your country or region of residence for your seller currency conversion charge information.

| Seller registered address country or region | Seller currency conversion charge |

|---|---|

| Malaysia, Israel | 2.5% |

| Latin America* | 3.5% |

| All other eBay global countries | 3.0% |

Examples of fee calculations

Auction-style listing example

You're a Basic Store subscriber and you're selling a handbag using a 10-day duration. You select a starting price of $199 with a Buy It Now price of $400, and you offer free shipping. You haven't yet used your allocation of zero insertion fee listings this month, and you are meeting our performance expectations.

The item sells immediately for the Buy It Now price of $400. Since you aren't charging the buyer for shipping or any other costs, $424 is the total amount of the sale (includes 6% sales tax).

Your total fees for this item:

- Insertion fee — $0.00

- Buy It Now fee — Free

- Final value fee (13% of $424 + $0.40) — $55.52

Total fees — $55.52

You make $344.48, or approximately 86% of the sale price, not including shipping costs.

Fixed price listing example

You're a new Starter Store subscriber and you haven't yet used your monthly allocation of zero insertion fee listings. You list a ski jacket for $65 with a free shipping option, and you add a subtitle to help the listing stand out. You're meeting our performance expectations.

The jacket sells quickly and the buyer selects the free shipping option. The total amount of the sale is $68.90 (includes 6% sales tax).

Your total fees for this item:

- Insertion fee — $0.00

- Subtitle fee — $2

- Final value fee (13.6% of $68.90 + $0.40) — $9.77

Total fees — $11.77

You make $53.23, or approximately 82% of the sale price.

Other terms and conditions

eBay always wants to make sure we're very clear about the fees it charges, so here are some details you should be aware of:

- If you use supplemental services, such as buying and printing shipping labels on eBay, or if you participate in any of its advertising programs, additional terms may apply and you'll pay any costs or fees associated with those services. Details of the costs or fees will be on your monthly financial statement and eBay will charge the payment method you've set up on your seller account

- All fees are in US dollars

- Sellers may be invoiced for fees under certain circumstances

- Fees may apply if you end your auction-style listing early

- The fees on this page apply to listings on ebay.com. If you list an item on another eBay site (for example, eBay.com.au or eBay.co.uk), the fees for that site will apply

- Seller fees don't purchase exclusive rights to web pages on eBay. eBay may, in its sole discretion and without consent from or payment to sellers, display third-party advertisements (including links and references thereto) and listings from other sellers on any eBay page

- Depending on the tax legislation of your country of residency, local Value Added Tax (VAT), Goods and Services Tax (GST) or similar consumption tax might apply in addition to your eBay fees

- Read the eBay Stores Subscription Terms of Service

Fees pages on international sites

For more information, please refer to the fee page for your country/region of residence:

Frequently asked questions

If I subscribe to an eBay Store, does that mean I’m officially a business?

Subscribing to an eBay Store does not automatically classify your account as a business account. Find out how to register as a business on eBay.

How do I edit or cancel my Store subscription?

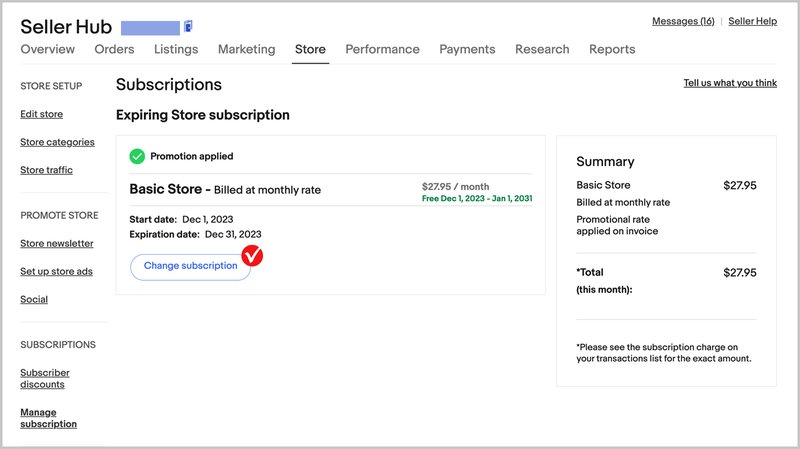

Visit your Subscription management page to view your current Store level and billing cycle:

- In Seller Hub, go to Store tab > Manage subscription

- In My eBay, go to Account > Subscriptions

- Or use the quick link

Then click Change subscription or Cancel subscription to upgrade your eBay Store (change the level or duration) or cancel the subscriptions.

Your live listings will remain live on the site after changing your Store subscription level.

How and when am I charged for my eBay Stores subscription?

Eligible sellers may subscribe to an eBay Store at any time during the year. The subscription fee will appear on your monthly invoice.

The first month of your subscription is prorated based on your sign up date. For example, if you sign up on April 27th and you're billed on the 1st of every month, you will be charged for the remaining 4 days in April (27, 28, 29, and 30) plus the month of May on May 1st.

Should you decide to cancel your subscription, you may do so at any time. You will have the full benefit of your subscription through the last day of the month you've cancelled in. For example, if you cancel your subscription on May 26th, you will have the full benefits of the subscription through May 31st, as you have already paid through to the end of the month. Your subscription will then be cancelled and you will not be billed on June 1st.