Guidelines for VAT on electronic commerce

From 2020, eBay has been required to collect import Value Added Tax (VAT) on certain items shipped to consumer buyers in Norway.

The VOEC scheme has similarities with the EU VAT e-commerce package that entered into force in 2021. The VOEC scheme applies to items with a value below 3,000 NOK, that are not prohibited or restricted items, foods or foodstuffs or items subject to excise duties (these items will be charged with VAT and duties at the border). eBay does not collect VAT on items with a value at or above 3,000 NOK as this is generally collected at the Norwegian border.

If the item is within the 3,000 NOK threshold of the VOEC scheme, eBay calculates the VAT on the order total (including shipping and any additional costs such as insurance). The buyer will see the VAT included in the order total at checkout. The seller will receive the item plus shipping cost, and eBay will remit the VAT to the Norwegian Tax Administration.

See if you need to take any action

When listing the item, sellers are not required to provide additional information.

Items up to 3,000 NOK (VAT is collected by eBay)

Mark the consignments to Norwegian buyers with eBay's VOEC identification number and relevant information (the contents of the parcel, including value, description and quantity of items) to ensure correct customs clearance.

The VOEC number is provided in a number of locations:

- In the eBay order in the field Consignee Address

- As part of the buyer address

- In the eBay reference field passed through an API and on the View Order Details page

From 1 January 2024, you must always provide the VOEC number to your carrier as the carrier will be responsible for electronic transmission of the number to the Norwegian Customs.

Please note: For all items which arrive in Norway after 1 January 2024, the VOEC number needs to be shared electronically by the carrier to the Norwegian Customs authorities, just putting it on the label doesn't work. This means that sellers will need to make sure to give the VOEC number to the carriers as well as listing it on the label.

Since VAT has already been charged on the items, provided the goods are cleared electronically through the VOEC system, there should be no additional VAT collected at the border for VOEC items.

However, if the parcel cannot be identified as within the VOEC scheme, there are risks of delayed border crossing and double taxation. For transactions where eBay has collected VAT, eBay will issue an invoice to the buyers confirming the VAT amount charged and showing the eBay’s VOEC number. If the buyer is asked to pay VAT again on import of the items into Norway, please inform the buyer to check the invoice and share it with customs. You can also share the order details with the buyer where eBay’s VOEC number and the VAT amount collected by eBay will be visible.

Items that can’t be sent as VOEC items (VAT is not collected by eBay)

The VOEC scheme does not apply to all types of items with value below 3,000 NOK. This means that eBay cannot collect VAT on all items, and certain types of items must be sent and cleared through customs in a different way.

The following types of items cannot be imported under the VOEC scheme:

- Foodstuffs

- All types of food and beverages, including nutritional and dietary supplements that are not medicinal drugs. Special rules apply to the import of medicinal drugs

- Items subject to excise duties. Read more about excise duties

- Illegal items and items restricted according to Norwegian legislation. Read about items with import restrictions at Norwegian Customs

Items at or above 3,000 NOK (VAT is not collected by eBay)

For items with a value at or above 3,000 NOK, as well as foodstuffs, restricted items, and items subject to excise duties, eBay will not collect VAT. These items will be subject to collection of VAT, excise duties and customs duties on import into Norway. Carriers may also charge the buyer an additional fee for calculating and paying the import charges.

FAQs

What is VOEC?

VOEC (VAT On E-Commerce) is the simplified scheme established for sellers and online marketplaces to register, declare and pay VAT on supplies of low value items to Norwegian consumers.

What is a VOEC number?

A VOEC number is the number under which eBay collects Norwegian VAT, and remits it to the Norwegian tax authorities. For the purposes of clearing items through Norwegian Customs, this means that the buyer has already paid the tax and the Customs authorities don't have to collect it.

You also need to know:

- VOEC number should match the marketplace that has collected and remitted VAT for your orders sent, — otherwise it will get stuck at Norway customs

- For orders at and above 3,000 NOK eBay will not collect VAT, and the buyer will have to pay it on the shipment delivery*

- If you need more information on how your shipping company works with the VOEC, please contact them directly for clarification

* Please note: The VOEC scheme does not apply to all types of items with a value below 3,000 NOK. This means that certain types of items must be sent and cleared through customs in a different way, regardless of their value. Learn more about items that cannot be imported under the VOEC scheme

How can I find the VOEC number and what should I do with it?

The VOEC number is provided in a number of locations:

- in the eBay order in the field Consignee Address

- as part of the buyer address

- in the eBay reference field passed through an API and on the View Order Details page

From 1 January 2024, you must always provide the VOEC number to your carrier as the carrier will be responsible for electronic transmission of the number to the Norwegian Customs.

How do I apply the 3,000 NOK threshold correctly?

The 3,000 NOK threshold is applied per item — not per consignment. eBay will apply this threshold automatically based on the sale value of the goods. Additional costs and fees (e.g. shipping, insurance costs, taxes) are excluded when determining if the value is within the 3,000 NOK threshold (but to be included when calculating the VAT).

What if I don’t use the VOEC number?

In this case, your buyers may have to pay VAT again on delivery. For transactions where eBay has collected VAT, eBay will issue an invoice to buyers confirming the VAT amount charged and showing eBay’s VOEC number. If your buyer is asked to pay VAT again on import of the items into Norway, please inform them to check the invoice and share it with customs. You can also share the order details with your buyer where eBay’s VOEC number and the VAT amount collected by eBay will be visible.

Please note: Buyers who do have to pay double VAT can be reimbursed the VAT charged by eBay by submitting a request for refund along with proof of payment of the VAT to Customs.

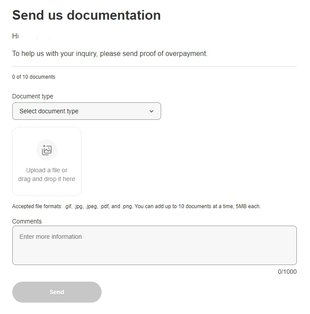

To request a VAT refund on a completed order, please click the button below, login and upload proof of overpayment.

Do I have to provide a VOEC number if I ship items with eBay International Shipping?

No, as eBay International Shipping takes care of the international leg of shipping your items to the buyers, the handling agent will automatically ensure that the correct details are added at shipment, including the VOEC where applicable

Can I combine VOEC items into one shipment?

A multiple-item shipment where individual items each have a value of less than 3,000 NOK is still considered a “shipment of low value items”, even if the total value of the consignment exceeds the 3,000 NOK threshold. eBay will collect VAT on each item.

On the other hand, if a multiple-item shipment consists of one or more items valued above the 3,000 NOK threshold, or one or more items that fall outside of the VOEC scheme (e.g. foodstuffs or restricted items), the consignment must be split into separate consignments in order to avoid ordinary customs declaration of the low value items.

Please note: Any unbundling or separation of items that are offered and sold as one unit to avoid passing the value limit of the VOEC scheme is prohibited.