Tax regulations in Egypt and Bosnia and Herzegovina require that eBay collects Value Added Tax on fees charged to sellers residing in these countries.

Egypt

Starting from October 2023, VAT of 14% applies to all fees charged to private sellers residing in Egypt. It means that 14% is added to the amount of their eBay fees. When charged by eBay, this tax is included in seller invoices and remitted by eBay to the Egyptian tax authorities.

Business sellers have to provide their VAT number (a 9-digit tax registration number) to enable eBay to apply the seller exemption for VAT. Sellers will then have to self-assess 14% Egyptian VAT on eBay fees under the appropriate Egyptian reporting mechanism.

How to register your VAT number with eBay if you are a business seller:

- In My eBay:

- Go to the Account tab.

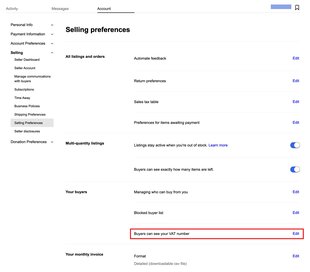

- Select Selling preferences and scroll down to Your buyers section.

- Click Edit next to Buyers can see your VAT number.

- Or use the quick link.

Then select the country, enter and submit your details.

Bosnia and Herzegovina

Starting from October 2023, VAT of 17% applies to all fees paid by all eBay sellers (both B2C and C2C) residing in Bosnia and Herzegovina. This tax is included in seller invoices and will be remitted by eBay to the tax authorities in Bosnia and Herzegovina.

eBay net fees will not be affected by these regulations and there will be no change to the services provided to you. Also, this will not impact your listings and you will not need to update anything.

For more information read eBay's tax policy. If you have questions regarding your VAT obligations, please contact your tax adviser or responsible tax office.